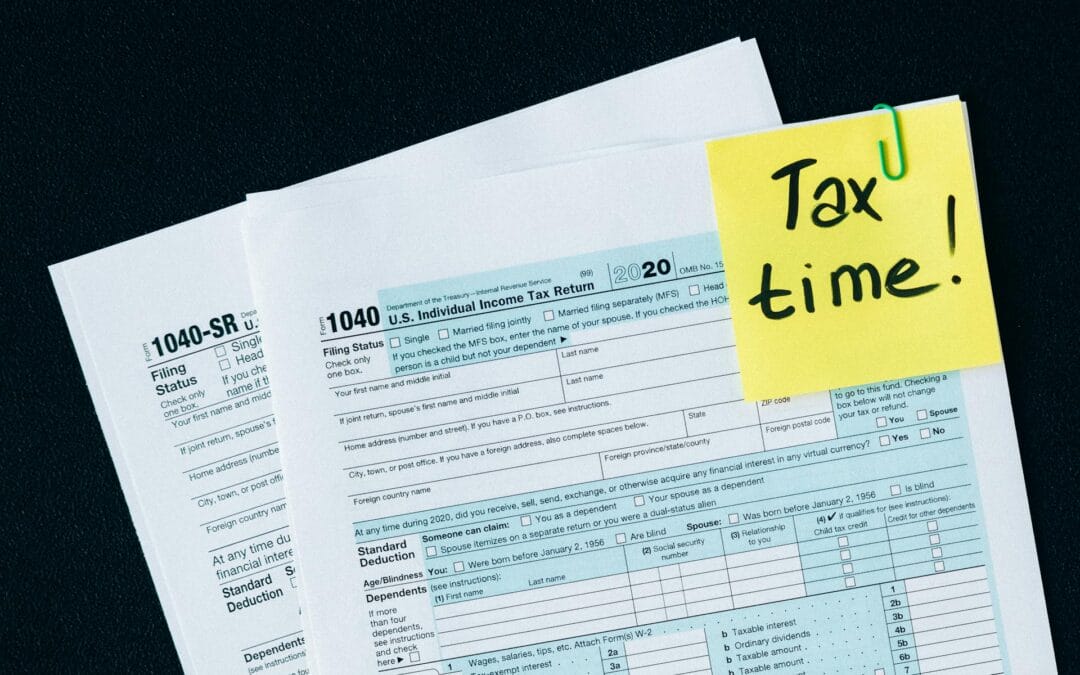

by speedytaxpreparation | Aug 17, 2025 | Business

Filing an S-corporation tax return takes time, organization, and a good amount of attention to detail. But even the most careful business owners can run into situations where corrections need to be made after filing. That’s where an amended return comes in. Whether...

by speedytaxpreparation | Aug 10, 2025 | Tips & Tricks

Being self-employed has its perks. You can set your hours, choose your clients, and build something that’s truly your own. But when tax season shows up, things can get complicated quickly. Unlike a typical employee who gets a W-2 and has taxes taken out...

by speedytaxpreparation | Jul 13, 2025 | Business, Tips & Tricks

Running a C-Corporation comes with the hefty responsibility of meeting various tax obligations. One of the most important aspects of corporate tax management is ensuring timely filing. Missing tax deadlines can feel like no big deal at first, but the repercussions can...

by speedytaxpreparation | Jul 6, 2025 | Business

Keeping your business’s financial books balanced might seem straightforward, but many business owners know it can be anything but. The process requires careful attention to detail and can quickly become overwhelming, especially when the numbers don’t add...

by speedytaxpreparation | Jun 29, 2025 | Business

Understanding how financial elements fit into business planning can change the way you approach day-to-day operations. One crucial aspect of this is customized payroll reporting. Imagine having a tool that not only handles payroll but also helps forecast future...